Know the Score: RealScore and Traditional Credit Scores

After we launched RealScore, the first crypto scoring platform for buyers and sellers of luxury real estate, on August 9, we received thousands of inquiries from interested parties looking to access this important breakthrough.

When fielding inquiries, one of the most frequently asked questions I get asked is this: is RealScore just like a credit score or is it something different altogether?

The short answer: it’s both.

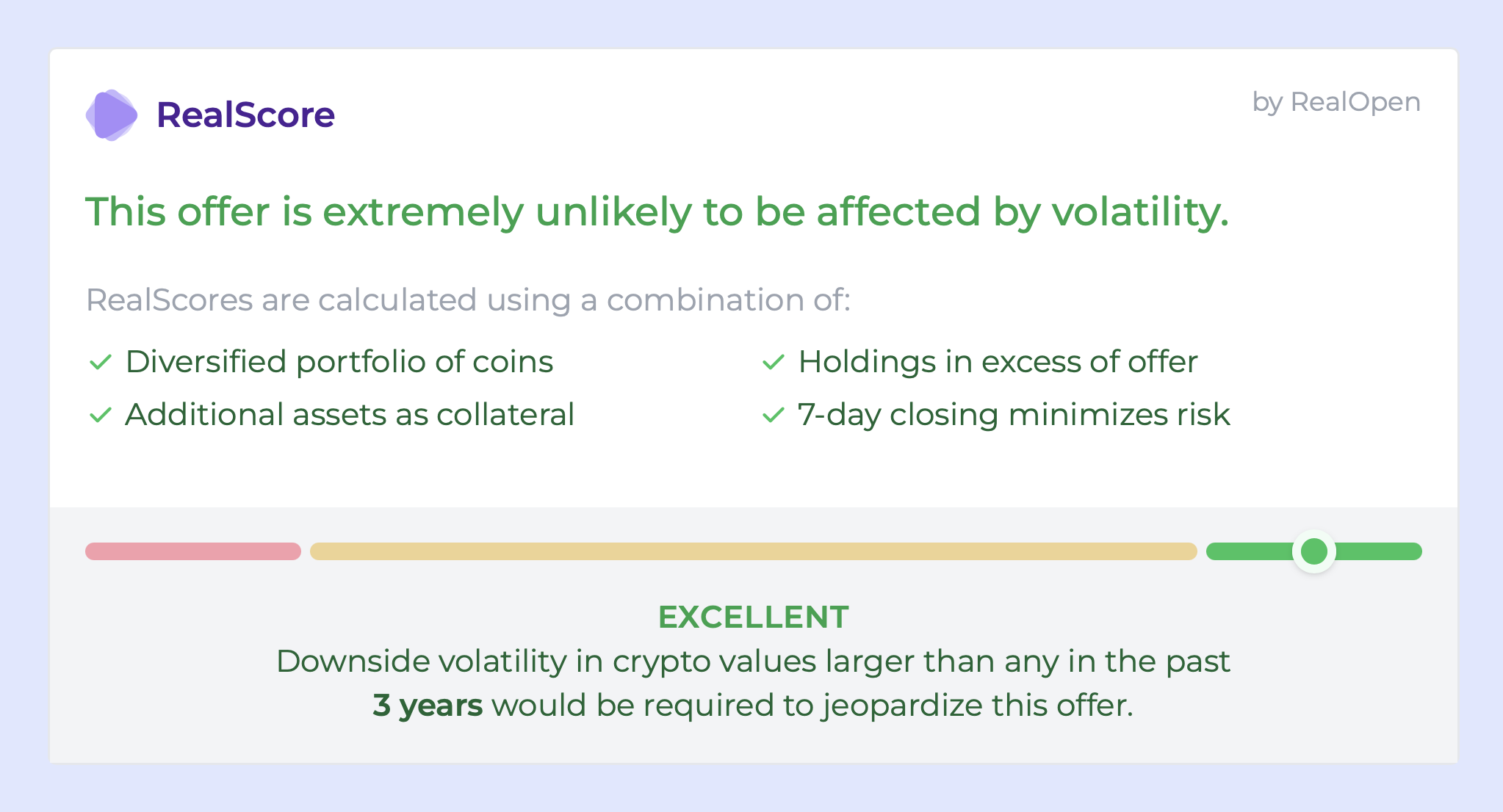

RealScore is analogous to a traditional credit score, in that it deems a crypto buyer as viable to a home seller, much like a credit score does for consumers to lenders. Not only does RealScore accurately measure the buyer’s purchasing power, the platform also offers predictive indicators to the seller to assess the strength of a real estate offer. And, like traditional credit scores, it offers digestible at-a-glance data with a simple color-coded scale.

At the same time, RealScore is not a true, literal credit score. Based on independently verifiable data, it is not meant to predict the buyer’s future behavior. And, perhaps most importantly, it cannot be manipulated by the buyer.

RealScore and credit scores are applicable in different situations rather than competing concepts. While credit scores are useful when borrowing or financing a purchase, RealScore is essential when using cryptocurrency as the source of funds. Traditional credit scores are not designed to support crypto-based transactions as they are based on past behavior and not influenced by external events. For example, large consumer credit reporting agencies like Equifax, Experian and TransUnion use traditional and seemingly static historical data that cannot accurately handle the dynamic, real-time volatility intrinsic to the current state of crypto.

Moreover, a credit score offers predictive value based on the buyer’s financial habits when applied to a real estate transaction. However, a buyer’s situation and behavior can change. And, credit scores can be manipulated via "credit repair companies.” Such companies exist to beat algorithms that were designed to assess behavior. In other words, a buyer can pay to increase their credit score without improving their behavior.

On the other hand, a credit score can needlessly penalize a buyer without a clear path or timeline to resolution. In contrast, RealScore is a real-time view of the buyer’s current financial situation and cannot be manipulated by the buyer.

The Future of Crypto-Driven Real Estate

Crypto-driven property transactions are rising as luxury real estate buyers and sellers realize the importance of asset diversification amidst today’s uncertain market conditions. Bitcoin and Ethereum underwent major downside volatility during the first half of this year, and now, both are up substantially (+24% and +82% for BTC and ETH, respectively, over the past 30 days). This volatility is what makes crypto so interesting and is not seen in any other major asset class.

That being said, this level of volatility makes crypto-driven real estate transactions a risky business – unless you have RealScore. Without it, a buyer is gambling with their escrow deposit while facing an uphill battle against a seller who associates crypto with complexity and volatility. Furthermore, RealScore bridges digital assets with the physical world, providing a reliable connection to crypto’s digital island.

Connecting the digital and physical worlds is essential for the future of crypto-driven real estate transactions especially as the rate of crypto innovation accelerates with an influx of increasingly sophisticated financial instruments. Not only does RealScore reduce risk for buyers and sellers alike, it also reduces the complexity associated with these more complicated transactions.